Case Study: Understanding ONDC and Integrating the Seller Apps

In this story, we try to decode ONDC — digging into the background, how it is expected to disrupt the e-commerce and other businesses in India, and how any application can be onboarded as Seller App o

Digital Commerce and India

India’s E-commerce market currently stands at $100 billion and is expected to grow with a 19% CAGR and reach $400 billion by 2030. While India’s retail currently stands at $1.2Trillion — eCommerce sharing around 7% share — is expected to grow to 11.4% by 2026. With a population of about 1.39 billion and with an internet penetration of around 61%, we have around 930 million internet users out of which just around 160 million are online shoppers (11%) — this gives us an idea of how huge the market is and is growing at the rapid rate.

ONDC’s chief business officer Shireesh Joshi’s vision is to have 30 million sellers and 300 million shoppers by 2024 —

“Double e-commerce value in five years, a 100-fold increase in the number of retailers online, and triple the number of people who buy online.”

Challenges and Opportunities of the Indian Digital Commerce

Digital Exclusion of the Kirana Stores

With 140 million Kirana (hyper-local provision) stores in India, which account for nearly 80% of the retail sector, most of these stores are unorganized and digitally excluded. Buying from a “near and now” online store is still a vacuum since even the quick-commerce start-ups — Dunzo, SwiggyInstamart, BlinkIt, and Zepto have their own dark stores rather than relying upon the local Kirana stores.

Huge Scope of growth for Digital Retail Market

The Gross Merchandise Value(GMV) of digital commerce for retail currently stands at 4.3% (around 38 Billion USD) — this is way below the other economies — China (25%), South Korea (26%), and the UK (23%)

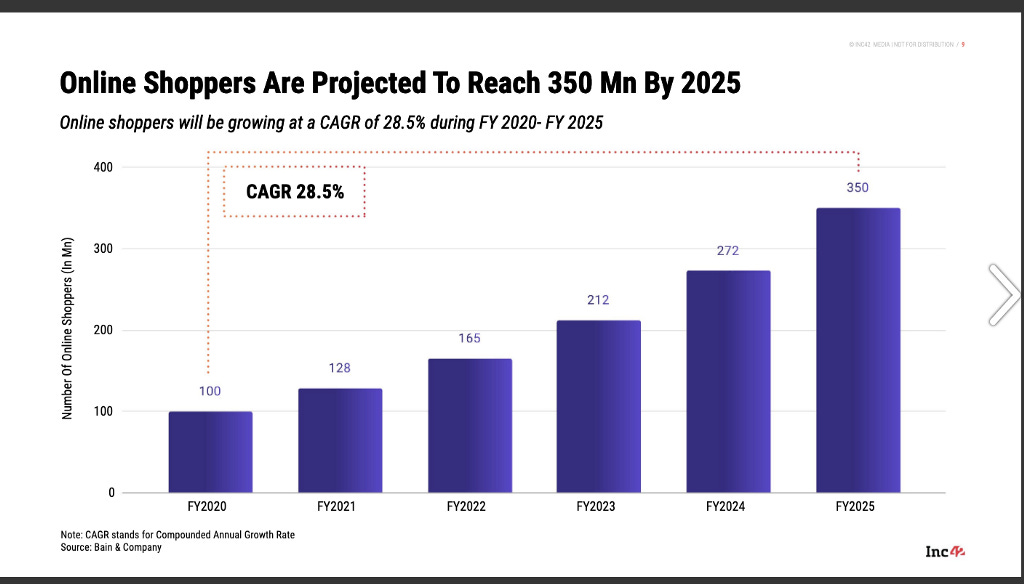

Increasing Online Shoppers

With around 165 million online shoppers in India growing with a 28% CAGR, the Indian shoppers will reach 350 million by 2025 and 500 million by 2030. To have inclusive growth for the ecosystem, these new buyers must be given a variety of options to choose from based on location, budget, and logistic choices.

The Duopoly in the Indian E-commerce

The current market is dominated by Big players like Flipkart (owned by Walmart) and Amazon. These tech giants are being accused of offering heavy discounts, manipulating search results, and providing fake reviews in recent times. Since these companies have become so large, it has become impossible for newer smaller players to enter the market and sustain themselves — this has led to these giants getting evolved as large ecosystems providing a marketplace, warehousing, logistics, payment, etc.

With the increasing size of the platforms, the buyers and sellers also face the concentration risk from the platforms. Even if it is a government-run platform, consolidating most of the trade of digital commerce in one platform increases the risk and creates a single point of failure. With that concentration of faculty, the liberty of exclusion, discretionary behavior also starts to set in. This way, the platforms become ‘operators’ within the market and the small and medium businesses lose the choice and freedom of participation at their own will or terms

Model of value creation and exchange turns the platforms into a major ‘store’ or ‘keeper’ of value which locks sellers into a specific system. The “store of value” paradigm has impacted the large, unhindered, free-to-scale “flow of value” that a fair and efficient market should have.

If the sellers wish to be in multiple platforms, they are required by the platforms to maintain separate infrastructure and processes, adding to their cost which also limits participation. Each platform will have its own terms & conditions that limit the flexibility of the sellers and with such limited flexibility, the extent and diversity of participation could be constrained. Further, the buyer and seller need to be on the same platform to discover each other. Such lacunae lead to limiting the choice & discoverability within the fragmented collection of platforms

— ONDC Strategy Paper

Understanding ONDC

ONDC provides an Open Network based on the open protocol that will enable location-aware, local commerce across industries to be discovered and engaged by any network-enabled application. This is similar to SMTP for email exchange, HTTP for World Wide Web, and UPI for Digital transactions.

ONDC aims to unbundle the actors — the sellers, buyers, logistics partners, warehousing providers, etc into granular components which can be onboarded on it. This means — the businesses can list themselves on the platform as the seller application or buyer application.

Building Blocks of ONDC

The building blocks of the ONDC can be simply understood by referring to the below figure

ONDC Network

The ONDC network comprises of network participants who join the ONDC as the buyer-side app, the seller-side app, or the gateway

Buyer-Side Apps — Any application that will interact with the demand layer for the goods or services. This could include User-based applications, voice assistants, chatbots etc

Seller-Side Apps — Any application for the supply layer of goods and services. These applications can receive buyer requests and, in response, publish their catalog of goods and services and fulfill buyer orders.

Gateway — This application would serve as the orchestrator for all the buyer and seller services. This application would handle the discovery of goods and services for the buyer based on the location by multicasting the request to the available sellers based on the location and customer preferences.

These applications would be interacting each other using Adaptor interfaces, the open APIs developed based on the open-source interoperable protocol by Beckn. Beckn is a non-profit founded by Nandan Nilekani, Pramod Varma and Sujith Nair in October 2019. They designed the first version of Beckn Protocol — a set of open-source specifications keeping mobility needs in mind. Hyperlocal players Dunzo, B2B startup Paisool, ShopX, Goodbox, logistics providers Delhivery, Shadowfax and payments fintech Juspay, which played a role in building the UPI ecosystem are some of the initial users of the Beckn protocol. In simple words, the Beckn protocol provides the standard specification for the sellers, buyers, and logistics applications to interact with each other. The protocol specifications can be found here

ONDC Network Services

These are the common services that allow the network participants to transact on the network

Registry: Application that maintains the list of participants who join ONDC.

Network policies: These are the rules and code of conduct for various activities that are performed by the network participants and will cover areas like registration, transaction, payment, data transmission, etc.

Data privacy policies: The data policy will be compliant with the Information Technology Act 2000 and there will be “efforts to comply with the emerging Personal Data Protection Bill” as stated in the ONDC Strategy Paper

Onboarding the Seller App on the ONDC Platform

The applications can list themselves as the buyer application or the seller application. The following figure represents how the application flow would look like on the buyer and the seller side —

Currently, as per the website, ONDC organizes regular business and technical onboarding calls weekly — to get the invitation, the business needs to write to the ONDC team at team@ondc.org.

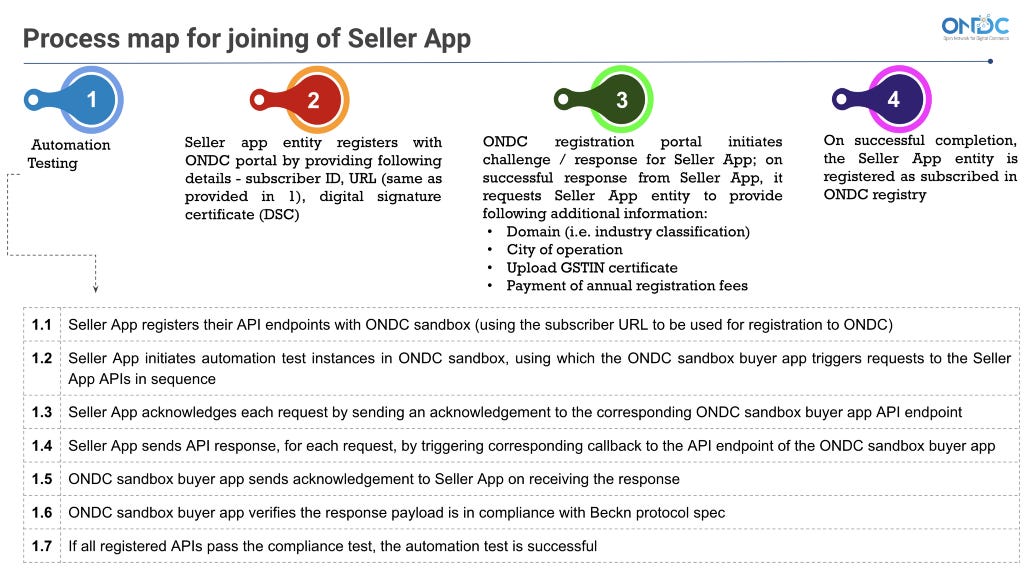

Post this step, the businesses — Network participant(NP) would need to do the following steps as per the ONDC documentation —

Network Participant (NP) generates self-signed digital certificates, with separate key pairs, for digital signature and encryption

NP needs separate digital certificates for onboarding as buyer node (BAP) and seller node (BPP)

NP initiates onboarding process to ONDC registry using the registry portal

NP provides required details for registration such as Subscriber ID, Country, Cities, Domain, Type (buyer node or seller node)

NP uploads their digital certificate on the portal.

Workflow is initiated for the subscription process.

After successful completion of workflow, ONDC registrar approves the request.

NP is ready for calling the subscribe API

Subscription APIs and schemas are available in the Swagger here

The process for onboarding the seller app and the buyer app is summarised in the presentation below —

After getting all the credentials from the Registry, we would be having the encryption_public_key, subscriber_id, signing_public_key etc details which would be used later for all the API requests. A snapshot from the Swagger Docs for the /lookup API —

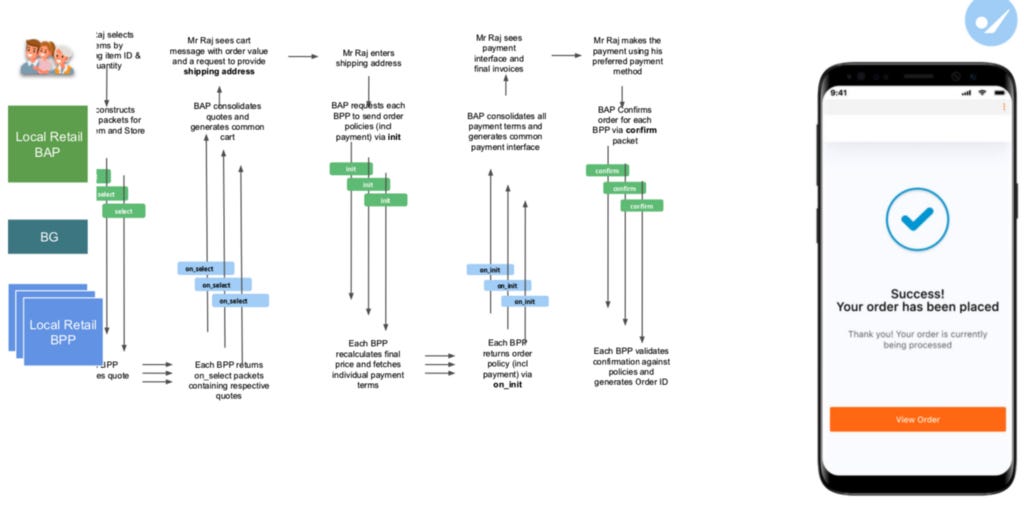

Transaction Flows on the ONDC

To understand how the transactions would work on ONDC — the best way is to understand how the transaction works on the Beckn protocol. The following two figures help in understanding the flow of the Local Retail Network and the Delivery network —

As we can see from the above flows — the following set of APIs will be called at the buyer’s end —

/search — the buyer searches the item or store based on the location, fulfillment method, pickup location, etc

/select — the buyer selects from the items returned by the search API and items to his/her cart

/init — the buyer accepts the quote from the seller and shares the billing details to generate an invoice

/confirm — the buyer receives the updated policy and quote and makes the payment online or makes the promise to make the payment for cash on delivery

/status — the buyer check the latest status of the order

/track — the buyer tracks the order and expects the current location of the package

/update — the buyer updates the billing address, fulfillment address, adds add-on items, or changes the payment method based on the updated policy

/cancel — the buyer cancels the order based on the cancellation policy

/rating — the buyer after the fulfillment completion sends the rating and the rating reason

/support — the buyer contacts customer support for help on items, stores, or fulfillment.

The following set of APIs will be called at the seller’s end —

/on_search — based on the search request, the list of the matching items, stores, or categories is returned to the buyer

/on_select — the seller shares the quote for a total value in the cart

/on_init — the seller receives the billing/fulfillment details of the user and updates the quote with necessary charges (delivery, taxes, etc.) along with the payment terms and fulfillment policy

/on_confirm — the seller receives the confirmation from the user, validates the proof or promise of payment, and returns the confirmed order ID

/on_track — the seller obtains a URL/WebSocket link with the view to the current location of the fulfillment agent from the fulfillment provider and returns it to the buyer node

/on_update — the seller generates a revised quote and returns it to the buyer along

/on_cancel — the seller receives the cancellation, based on the cancellation policy, returns a canceled order with refund terms

/on_rating — the seller receives the rating from the buyer and responds with an acknowledgment

/on_support — the seller receives a request for support from the buyer and responds back with a chat link/phone/email to its customer support agents

The above can also be understood with the following flowchart —

The Current State of ONDC

On the buyer side, payments companies like Paytm and e-commerce platforms like Snapdeal have partnered with the Network and are expected to go live soon. Hyperlocal-commerce company Dunzo is extending logistics services. Others like Google and Reliance are said to be in talks.

On the seller side, five seller aggregators — eSamudaay, Digit, GoFrugal, Growth Falcon, and SellerApp — have joined the Network. These aggregators are tasked with bringing millions of sellers onboard. This is where most of the action lies for the ONDC

Further Reading

All the documents for the ONDC integration can be found here. The sample JSON for all the API requests can be found here

Understanding the Transaction flows on the Beckn Protocol and Specs

Master Swagger for the app the ONDC API Specs

Links from the ken and economic times and MediaNama

Do You Know: You can clap up to 50 times per post or list, and you can use it to show the author how much you liked the story or list.

Technical Business Case Study: Understanding ONDC and Integrating the Seller Apps was originally published in Agile Insider on Medium, where people are continuing the conversation by highlighting and responding to this story.